Analyzing on-chain data using Covalent API + Python

TL;DR

This cookbook will go through how to extract and analyze on-chain data of Astar Network using Python and Covalent API. This cookbook is especially useful for non-devs who are not familiar with setting up indexers to query on-chain data. All steps can be done totally free without having to use a terminal or setting up a local development environment.

What is Covalent?

Covalent leverages big-data technologies to create meaning from hundreds of billions of data points, delivering actionable insights to investors and allowing developers to allocate resources to higher-utility goals within their organization. Instead of pain-stakingly sourcing data from a small handful of chains, Covalent aggregates information from across dozens of sources including nodes, chains, and data feeds. The Covalent API then sources end users with individualized data by wallet, including current and historical investment performance across all types of digital assets. Most importantly, Covalent returns this data in a rapid and consistent manner, incorporating all relevant data within one API interface.

Analyzing ArthSwap pool balance

As an example in this cookbook, we will analyze the change in the balance of ceUSDC/ceUSDT pool on ArthSwap. We will be using Python in this cookbook. For non-devs who are not familiar to setting up local environment to run Python, we recommend using Jupyter Notebook.

Make sure to sign up for Covalent to get the API key needed to run the code. (You can register here)

Step 1: Extract data

Before we do any data transformation and analytics, we need a list of historical portfolio data of ceUSDC/ceUSDT pool contract as our first step. To get the information, we need to send the following request (see the reference section in this cookbook for more info on API format):

GET /v1/{chain_id}/address/{address}/portfolio_v2/

In this request, parameter chain_id is the chain ID of the Blockchain being queried. In this cookbook, we will use chain_id = 593 (Astar Network) and contract address of ceUSDC/ceUSDT pool = 0xD72A602C714ae36D990dc835eA5F96Ef87657D5e as example. The following code uses Python to extract the data.

import requests

API_KEY = [YOUR_API_KEY]

base_url = 'https://api.covalenthq.com/v1'

blockchain_chain_id = '592'

address = "0xD72A602C714ae36D990dc835eA5F96Ef87657D5e"

def get_wallet_portfolio(chain_id, address):

endpoint = f'/{chain_id}/address/{address}/portfolio_v2/?key={API_KEY}'

url = base_url + endpoint

result = requests.get(url).json()

return(result)

portfolio_data = get_wallet_portfolio(blockchain_chain_id, address)

print(portfolio_data)

Below is a sample output:

{'data': {'address': '0xd72a602c714ae36d990dc835ea5f96ef87657d5e', 'updated_at': '2022-09-20T07:17:27.930341337Z', 'next_update_at': '2022-09-20T07:22:27.930341567Z', 'quote_currency': 'USD', 'chain_id': 592, 'items': [{'contract_decimals': 6, 'contract_name': 'USD Coin', 'contract_ticker_symbol': 'USDC', 'contract_address': '0x6a2d262d56735dba19dd70682b39f6be9a931d98', 'supports_erc': None, 'logo_url': '[https://logos.covalenthq.com/tokens/592/0x6a2d262d56735dba19dd70682b39f6be9a931d98.png](https://logos.covalenthq.com/tokens/592/0x6a2d262d56735dba19dd70682b39f6be9a931d98.png)', 'holdings': [{'timestamp': '2022-09-20T00:00:00Z', 'quote_rate': 0.9932833, 'open': {'balance': '391683183282', 'quote': 389052.34}, 'high': {'balance': '392123445379', 'quote': 389489.66}, 'low': {'balance': '316424219770', 'quote': 314298.88}, 'close': {'balance': '317469504720', 'quote': 315337.16}}, {'timestamp': '2022-09-19T00:00:00Z', 'quote_rate': 1.0022721, 'open': {'balance': '391991979278', 'quote': 392882.62}, 'high': {'balance': '392739045673', 'quote': 393631.4}, 'low': {'balance': '389667428685', 'quote': 390552.8}, 'close': {'balance': '391683183282', 'quote': 392573.16}}, ...

Step 2: Transform the data into lists

After data extraction is done in step 1, we will transform that data into three lists so it can be easily handled using Pandas, a data analytics library for Python. The code below creates a few functions that transform our data into lists.

import requests

import json

API_KEY = 'ckey_76799bb987a14e179ea6031d15c'

base_url = 'https://api.covalenthq.com/v1'

blockchain_chain_id = '592'

address = "0xD72A602C714ae36D990dc835eA5F96Ef87657D5e"

def get_wallet_portfolio(chain_id, address):

endpoint = f'/{chain_id}/address/{address}/portfolio_v2/?key={API_KEY}'

url = base_url + endpoint

result = requests.get(url).json()

return(result)

def get_timestamp_list(sample_data):

timestamp = []

for tmp in reversed(sample_data):

timestamp.append(tmp["timestamp"][5:10])

return (timestamp)

def get_token_balance_list(data):

token_balance_list = []

for tmp_data in reversed(data):

balance = tmp_data["open"]["balance"]

token_balance_list.append(int(balance) // 1000000)

return (token_balance_list)

portfolio_data = get_wallet_portfolio(blockchain_chain_id, address)

timestamp_list = get_timestamp_list(portfolio_data["data"]["items"][0]["holdings"])

usdc_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][0]["holdings"])

usdt_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][1]["holdings"])

print(timestamp_list)

print(usdc_token_balance_list)

print(usdt_token_balance_list)

The output will look as follows. The first list is a series of timestamps, the second is liquidity of USDC (in USD), and the third is liquidity of USDT (in USD) on each day.

['08-21', '08-22', '08-23', '08-24', '08-25', '08-26', '08-27', '08-28', '08-29', '08-30', '08-31', '09-01', '09-02', '09-03', '09-04', '09-05', '09-06', '09-07', '09-08', '09-09', '09-10', '09-11', '09-12', '09-13', '09-14', '09-15', '09-16', '09-17', '09-18', '09-19', '09-20']

[317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469, 317469]

[317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368, 317368]

Step 3: Transform the data to Pandas Dataframe

Now, let's transform the lists created in Step 2 into Pandas Dataframe so that they can be turned into a graph in next step.

import pandas as pd

import requests

import json

API_KEY = 'ckey_76799bb987a14e179ea6031d15c'

base_url = 'https://api.covalenthq.com/v1'

blockchain_chain_id = '592'

address = "0xD72A602C714ae36D990dc835eA5F96Ef87657D5e"

def get_wallet_portfolio(chain_id, address):

endpoint = f'/{chain_id}/address/{address}/portfolio_v2/?key={API_KEY}'

url = base_url + endpoint

result = requests.get(url).json()

return(result)

def get_timestamp_list(sample_data):

timestamp = []

for tmp in reversed(sample_data):

timestamp.append(tmp["timestamp"][5:10])

return (timestamp)

def get_token_balance_list(data):

token_balance_list = []

for tmp_data in reversed(data):

balance = tmp_data["open"]["balance"]

token_balance_list.append(int(balance) // 1000000)

return (token_balance_list)

portfolio_data = get_wallet_portfolio(blockchain_chain_id, address)

timestamp_list = get_timestamp_list(portfolio_data["data"]["items"][0]["holdings"])

usdc_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][0]["holdings"])

usdt_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][1]["holdings"])

lp_df = pd.DataFrame(data = [usdc_token_balance_list, usdt_token_balance_list], index = ["USDC", "USDT"], columns = timestamp_list)

print(lp_df.T)

The output will look as follows. You can see that the lists have turned into a dataframe.

USDC USDT

08-21 446081 451625

08-22 453840 459288

08-23 455964 461331

08-24 455846 461451

08-25 456262 461089

08-26 455285 461550

08-27 457687 463863

08-28 456071 462506

08-29 460596 465996

08-30 449226 454343

08-31 429668 435999

09-01 430336 435230

09-02 331040 335945

09-03 321951 327345

09-04 221460 227266

09-05 226810 231804

09-06 237230 242222

09-07 302571 308771

09-08 293992 299795

09-09 292354 297289

09-10 292838 297973

09-11 296315 301463

09-12 296068 301855

09-13 296641 301435

09-14 408155 413254

09-15 289567 294152

09-16 393641 398622

09-17 391511 395897

09-18 392412 396156

09-19 391991 396653

09-20 391683 392573

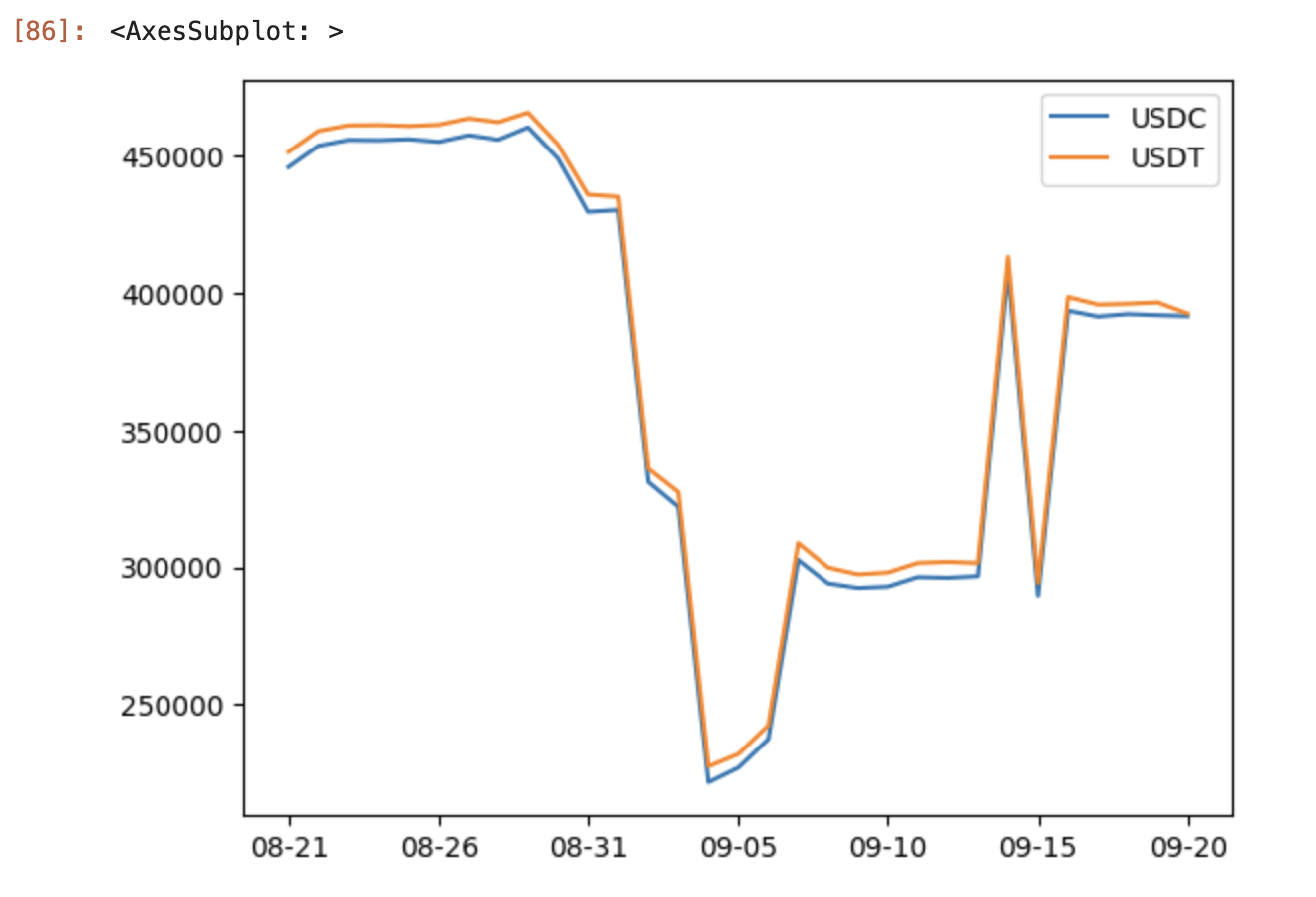

Step 4: Visualizing the data

In this final step, we will use our dataframe to visualize the liquidity of USDC and USDT in the pool for each day.

%matplotlib inline

import pandas as pd

import matplotlib as mpl

import matplotlib.pyplot as plt

import requests

import json

API_KEY = 'ckey_76799bb987a14e179ea6031d15c'

base_url = 'https://api.covalenthq.com/v1'

blockchain_chain_id = '592'

address = "0xD72A602C714ae36D990dc835eA5F96Ef87657D5e"

def get_wallet_portfolio(chain_id, address):

endpoint = f'/{chain_id}/address/{address}/portfolio_v2/?key={API_KEY}'

url = base_url + endpoint

result = requests.get(url).json()

return(result)

def get_timestamp_list(sample_data):

timestamp = []

for tmp in reversed(sample_data):

timestamp.append(tmp["timestamp"][5:10])

return (timestamp)

def get_token_balance_list(data):

token_balance_list = []

for tmp_data in reversed(data):

balance = tmp_data["open"]["balance"]

token_balance_list.append(int(balance) // 1000000)

return (token_balance_list)

portfolio_data = get_wallet_portfolio(blockchain_chain_id, address)

timestamp_list = get_timestamp_list(portfolio_data["data"]["items"][0]["holdings"])

usdc_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][0]["holdings"])

usdt_token_balance_list = get_token_balance_list(portfolio_data["data"]["items"][1]["holdings"])

lp_df = pd.DataFrame(data = [usdc_token_balance_list, usdt_token_balance_list], index = ["USDC", "USDT"], columns = timestamp_list)

lp_df.T.plot()

The output will look as follows:

That's it!

This guide demonstrated how we can easily visualize the historical balance of ceUSDC/ceUSDT pool on ArthSwap using Covalent and Python. Creating a graph like this can be a useful reference tool for your project. For example, anyone can use the graph in this eample to see the liquidity for both USDT and USDC on 9/20 was $400K. No need to go digging for specific on-chain data.

This is just a simple example. There is a lot of API opened by Covalent and endless ways to use those data to create insightful graphs, and other reference resources.

Reference

- Covalent API resource

- Covalent docs